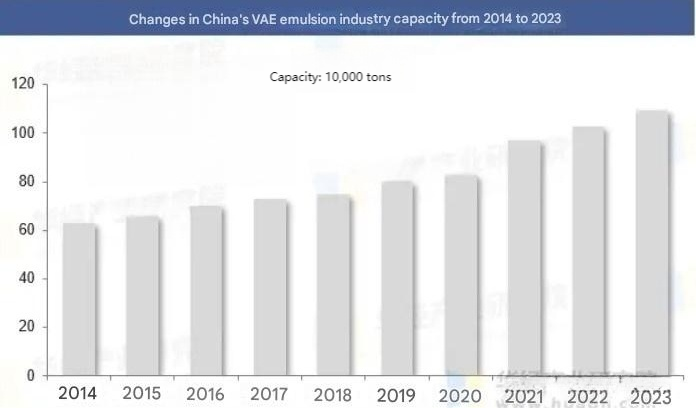

Изменения в Китайская эмульсия VAE Производственные мощности в значительной степени обусловлены новыми строительными и расширенными проектами в отрасли. Например, запуск проекта по расширению коммерческого производства эмульсии VAE мощностью 20 000 тонн в год в провинции Цзянсу и объявление Celanese о расширении производственных мощностей эмульсии в Нанкине, Китай, были значительными. Китай является ключевым производителем эмульсий VAE в мире, поддерживаемым многими производителями и производственными линиями. В последнее время общие производственные мощности для эмульсий VAE выросли благодаря возросшим потребностям рынка и более совершенным технологиям. В целом, китайская промышленность по производству эмульсии VAE эффективно использует свои мощности, особенно в областях, где требуется большое количество клеев и наружной изоляции зданий. В этих областях производственные линии часто работают на пределе своих возможностей.

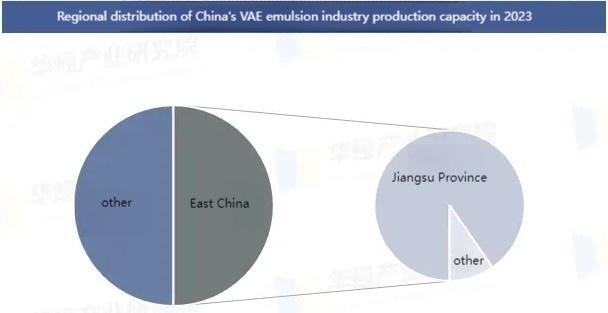

В 2023 году Восточный Китай, особенно провинции Цзянсу и Аньхой, стал крупнейшим в стране регионом по производству эмульсии ВАЭ. Они производили 620 000 тонн в год, что составляет более половины (56,88%) всего объёма производства в Китае. Наибольший объём производства произошёл в провинции Цзянсу, где ежегодно производилось 560 000 тонн, что составляет 51,38% от общего объёма производства в стране.

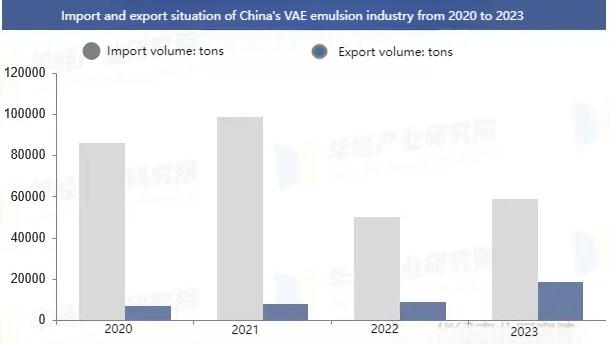

Китай является крупным производителем и поставщиком эмульсий ВАЭ, и его продажи в другие страны растут. В основном, они поставляются в Юго-Восточную Азию, Европу и Северную Америку. Благодаря невысокой стоимости и хорошему качеству, китайские эмульсии ВАЭ приобретают всё большую популярность на мировом рынке. Китайские компании совершенствуют свои исследования и теперь могут производить множество видов концентрированных, специальных эмульсий ВАЭ, что означает, что им не нужно закупать их в больших объёмах у других стран. Более высокое качество эмульсий ВАЭ, производимых в Китае, открывает перед ними широкие возможности, поэтому в 2021 году Китай значительно сократил свои закупки в других странах. По мере развития отрасли, Китай ежегодно продаёт всё больше и больше продукции в другие страны.

Рынок импорта эмульсии ВАЭ в Китае отличается высокой концентрацией. Спрос растёт, а стабильность цепочки поставок постепенно повышается. В 2023 году Тайвань был крупнейшим источником импорта эмульсии ВАЭ: объём импорта достиг 27 699,13 тонны, что составляет 47,06% от общего объёма импорта, увеличившись примерно на 35,54% в годовом исчислении. На втором месте оказался Сингапур с объёмом импорта 26 329,13 тонны, что составляет 44,74% от общего объёма импорта, увеличившись примерно на 18,47% в годовом исчислении.

Анализируя видимое потребление в китайской индустрии эмульсии VAE, с 2016 по 2021 год, можно отметить, что отрасль демонстрировала устойчивый рост, обусловленный спросом в сфере переработки и сбыта. В 2022 году, в связи со значительным падением производства и импорта, видимый спрос колебался, снизившись с 791 600 тонн в 2021 году до 661 700 тонн, что на 16,41% меньше по сравнению с предыдущим годом. Несмотря на восстановление видимого потребления в 2023 году, общая волатильность оставалась значительной. Уровень самообеспеченности вырос в 2022 и 2023 годах, но потребление, по-видимому, снизилось в 2022 году. Эксперты считают, что эта разница между изменениями производства и спроса может привести к слишком большому или слишком малому уровню запасов, что изменит функционирование спроса и предложения на рынке.

Эта статья представляет собой отрывок из «Анализа текущего состояния развития отрасли по производству эмульсии VAE в Китае в 2023 году: запуск проекта по расширению промышленного производства эмульсии VAE мощностью 20 000 тонн в год в провинции Цзянсу будет способствовать дальнейшему расширению мощностей в отрасли».

Исходя из доли рынка, распределенной по производственным мощностям, конкурентная среда в китайской отрасли производства эмульсий ВАЭ относительно концентрирована. Наибольшая доля рынка – 18,35% – принадлежит компании Wacker Chemie (China) Co., Ltd. Остальные доли компаний схожи. Оставшиеся 15,59% доли рынка принадлежат другим компаниям. Это свидетельствует о том, что на рынке доминируют несколько крупных компаний, но при этом наблюдается некоторая фрагментация: остальные компании в совокупности делят примерно одну шестую доли рынка.

Компания Wanwei High-Tech Materials Co., Ltd., занимающаяся в основном исследованиями, разработками, производством и продажей новых химических материалов, является ключевым направлением деятельности компании. Её эмульсионная продукция на основе ВАЭ используется в различных целях, в основном в клеях, покрытиях, строительных материалах и текстиле. Wanwei High-Tech обладает передовыми производственными методами и оборудованием, что позволяет ей производить качественные эмульсии ВАЭ, отвечающие различным потребностям клиентов. В 2023 году выручка компании от продажи эмульсий ВАЭ составила около 475 миллионов юаней.

Веб-сайт: www.elephchem.com

Вотсап: (+)86 13851435272

Электронная почта: admin@elephchem.com

JiangSu ElephChem Holding Limited, профессиональный эксперт рынка Эмульсия ВАЭ иПоливиниловый спирт (ПВС) с прочным признанием и превосходными производственными мощностями, соответствующими международным стандартам.